N° 1 of the Gold Purchase in Switzerland

WE BUY AT THE BEST PRICE ALL YOUR PRECIOUS METALS

RAPIDITY EFFECTIVENESS DISCRETION SELL YOUR GOLD SIMPLY

Understanding the price of gold

Knowing when to sell your gold obviously depends on how much you want to get for it. The price of gold is obviously one of the most essential indicators to follow. Let’s try to get a clearer picture.

Selling a piece of jewelry, a coin or an ingot in a gold store, whether it is for cash or to recuperate the fruits of an investment, involves behaviors and observations that require understanding some of the constants in the variations of the gold price.

Scarcity and demand for gold.

The value is based on two elements. On the one hand, there is the scarcity of a good or product. However, scarcity is not enough to give value to a thing. It must be associated with another factor: demand.

A product that is rare but has no demand whatsoever has no value. The combination of “demand” and “scarcity” is therefore essential.

Gold: a safe haven.

In the case of gold, as well as some other precious metals, but to a lesser degree, such as silver or platinum, another element must be taken into account: its status as a safe haven.

What is a safe haven? Simply put, it is an asset that is considered stable enough to be used as an investment, even temporarily, in the event of a crisis, whether economic, security or financial.

Today, gold is 6.5 times more valuable than it was 20 years ago. In the 90’s, the euphoria linked to the beginnings of the internet had caused the value of gold to plummet. The precious yellow metal went to make a spectacular recovery, often associated with crises.

The creation of the gold-paper or ETF (for Exchange Trade Funds) was going to allow, from the years 2000 to attract the investors and the speculators. However, as its name indicates, it is not a real possession, but a purchase on paper. Nevertheless, it has led to an increase in the value of gold due to the windfall effect. This type of investment carries risks because of its virtuality. Only physical gold is totally safe and remains the only investment that is recommended for individuals and professionals.

The subprime crisis in 2008 was to propel the value of gold to levels rarely equaled, and this until now.

When to sell your gold?

The answer to this question is simple: when you need money. Waiting for the price of gold to change is purely speculative and short-sighted. If you are in possession of gold acquired 5 years ago, 15 years, 20 years, 30 years or more, you are necessarily a winner because of the value of the metal in recent years, just look at the evolution of the price of gold for 20 years, 30 years or 50 years.

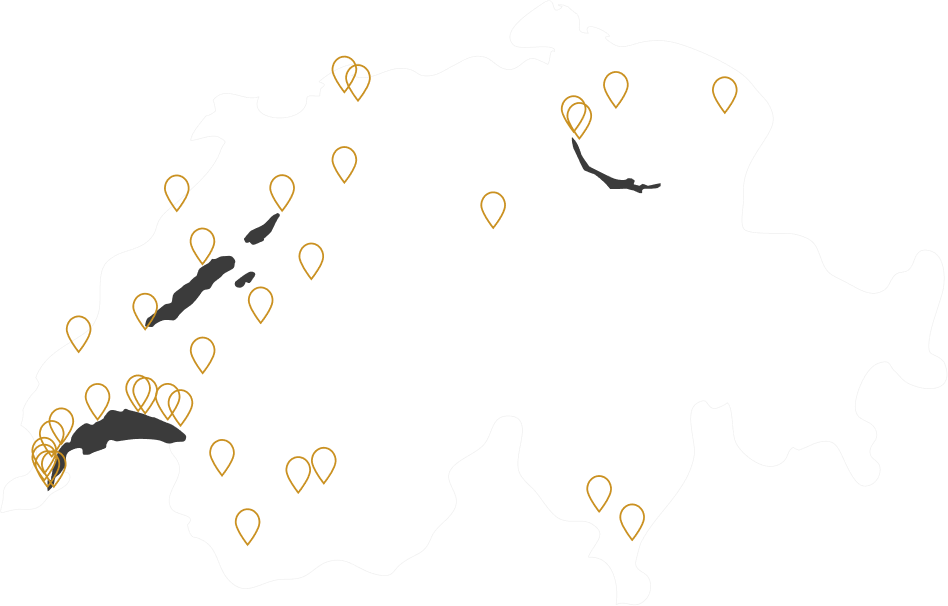

Our shops

Rue de la Gare, 39

1260 Nyon – Swiss

+41 (0)22 362 01 01

Boulevard James Fazy, 12

1201 Geneva – Swiss

+41 (0)22 732 24 24

Av. Pictet de Rochemont, 5

1207 Geneva – Swiss

+41 (0)22 740 55 55

Rue de la Confédération 5

1204 – Swiss

+41 (0) 22 810 47 47

Route de Ferney 169

1218 Geneva – Swiss

+ 41 (0)22 362 47 47

Av. de Feuillasse 24

1217 Meyrin – Swiss

+41 (0)22 990 15 15

Obertor 40

8400 Winterthur – Swiss

+ 41 (0)52 233 62 62

Closed

– Swiss

Route Suisse, 10

1163 Etoy – Swiss

+41 (0)21 843 12 12

Avenue de la Gare, 6

1003 Lausanne – Swiss

+41 (0)21 323 24 24

Rue des Terreaux, 20

1003 Lausanne – Swiss

+41 (0)21 323 04 04

Rue de Neuchatel 10

1400 Yverdon – Swiss

+41 (0)24 430 44 44

Rue des Poteaux 3

2000 Neuchatel – Swiss

+41 32 724 83 83

Zentralstrasse 30

2502 Biel – Swiss

+41 (0)32 914 05 05

Léopold-Robert 74

2300 La Chaux-de-Fonds – Swiss

+41 32 968 42 42

Rue du Conseil, 19

1800 Vevey – Swiss

+41 (0)21 922 13 13

Grand Rue, 84

1820 Montreux – Swiss

+41 (0) 22 732 24 24

Rue de Vevey, 16

1630 Bulle – Swiss

+41 (0)26 919 34 34

Place de l’Eglise, 5

1870 Monthey – Swiss

+41 (0)24 472 44 44

Rue de la Poste, 7

1920 Martigny – Swiss

+41 (0) 27 722 55 55

Route du Simplon 82

1958 Saint Léonard – Swiss

+41 (0) 27 203 49 49

Route de Sion, 21

3960 Sierre – Swiss

+41 (0)27 456 74 74

Rue Saint-Pierre, 10

1700 Fribourg – Swiss

+41 (0)26 495 36 36

Aeschenvorstadt 36

4051 Basel – Swiss

+41 (0)61 283 16 16

Untere Rebgasse 18

4058 Basel – Swiss

+41 (0)61 222 26 26

Hauptgasse 29

4500 Solothurn – Swiss

+41 (0)32 322 62 62

Uraniastrasse 40

8000 Zurich – Swiss

+41 (0)44 202 17 17

Schifflände 16

8001 Zurich – Swiss

+41 (0)44 350 47 47

Pilatusstrasse 17a

6003 Lucerne – Swiss

+41 (0)41 282 44 44

Gurtengasse 6

3011 Bern – Swiss

+41 31 318 86 86

Via al forte 10

6900 Lugano – Swiss

+41 (0)91 921 07 07

Spisergasse 23

9000 St. Gallen – Swiss

+41 (0)71 446 27 27

Via della posta 6

6600 Locarno – Swiss

+41 91 751 47 47

Via Teatro 9

6500 Bellinzona – Swiss

+41 (0)91 825 18 18

On Call

we move in all Switzerland

+41 (0) 22 362 01 01